EX-99.2 REGISTRANT'S SUPPLEMENTAL INFORMATION

Published on July 23, 2025

2Q 2025 Earnings July 23, 2025

2 Cautionary statement regarding forward-looking statements This Investor Update contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Specific forward-looking statements include, without limitation, statements related to (i) the Company’s initiatives, strategic priorities and focus areas, plans, goals, expectations, and opportunities, including timing expectations, with respect to (a) the optimization of the Company’s Chase cobranded credit card agreement and the Company’s loyalty program earn and burn rates, (b) marketing and distribution evolution, (c) revenue and network maturation, (d) airline partnerships, (e) bag fees, (f) basic economy fares, (g) flight credit expiration, (h) extra legroom seating, (i) seat assignments, (j) vacation products and Getaways by Southwest, (k) service modernization, (l) aircraft turn time, (m) 24-hour operations, and (n) cost reductions and cost efficiencies; (ii) the Company’s network plans and expectations; and (iii) the Company's financial and operational outlook, expectations, goals, plans, strategies, targets, and projected results of operations, including with respect to its initiatives, and including factors and assumptions underlying the Company's expectations and projections. These forward-looking statements are based on the Company's current estimates, intentions, beliefs, expectations, goals, strategies, and projections for the future and are not guarantees of future performance. Forward-looking statements involve risks, uncertainties, assumptions, and other factors that are difficult to predict and that could cause actual results to vary materially from those expressed in or indicated by them. Factors include, among others, (i) the impact of fears or actual outbreaks of diseases, extreme or severe weather and natural disasters, actions of competitors (including, without limitation, pricing, scheduling, capacity, and network decisions, and consolidation and alliance activities), governmental actions, consumer perception, consumer uncertainties with respect to trade policies (including the imposition of tariffs), economic conditions, banking conditions, fears or actual acts of terrorism or war, sociodemographic trends, and other factors beyond the Company's control, on consumer behavior and the Company's results of operations and business decisions, plans, strategies, and results; (ii) the Company's ability to timely and effectively implement, transition, operate, and maintain the necessary information technology systems and infrastructure to support its operations and initiatives, including with respect to revenue management and assigned and premium seating; (iii) consumer behavior and response with respect to the Company's new commercial products and policies; (iv) the impact of fuel price changes, fuel price volatility, and fuel availability on the Company's business plans and results of operations; (v) the Company's dependence on The Boeing Company (“Boeing”) and Boeing suppliers with respect to the Company's aircraft deliveries, Boeing MAX 7 aircraft certifications, fleet and capacity plans, operations, maintenance, strategies, and goals; (vi) the Company's dependence on the Federal Aviation Administration with respect to, among other things, the certification of the Boeing MAX 7 aircraft; (vii) the Company's dependence on other third parties, in particular with respect to its technology plans, its plans and expectations related to revenue management, online travel agencies, operational reliability, fuel supply, maintenance, Global Distribution Systems, environmental sustainability, and the impact on the Company's operations and results of operations of any third party delays or nonperformance; (viii) the Company’s ability to timely and effectively prioritize its initiatives and focus areas and related expenditures; (ix) the impact of labor matters on the Company's business decisions, plans, strategies, and results; (x) the impact of governmental regulations and other governmental actions, as well as the Company’s ability to obtain any required governmental approvals, on the Company's business plans, results, and operations; (xi) the Company's ability to obtain and maintain adequate infrastructure and equipment to support its operations and initiatives; (xii) the Company's dependence on its workforce, including its ability to employ and retain sufficient numbers of qualified Employees with appropriate skills and expertise to effectively and efficiently maintain its operations and execute the Company’s plans, strategies, and initiatives; (xiii) the cost and effects of the actions of activist shareholders; and (xiv) other factors, as described in the Company's filings with the Securities and Exchange Commission, including the detailed factors discussed under the heading "Risk Factors" in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2024.

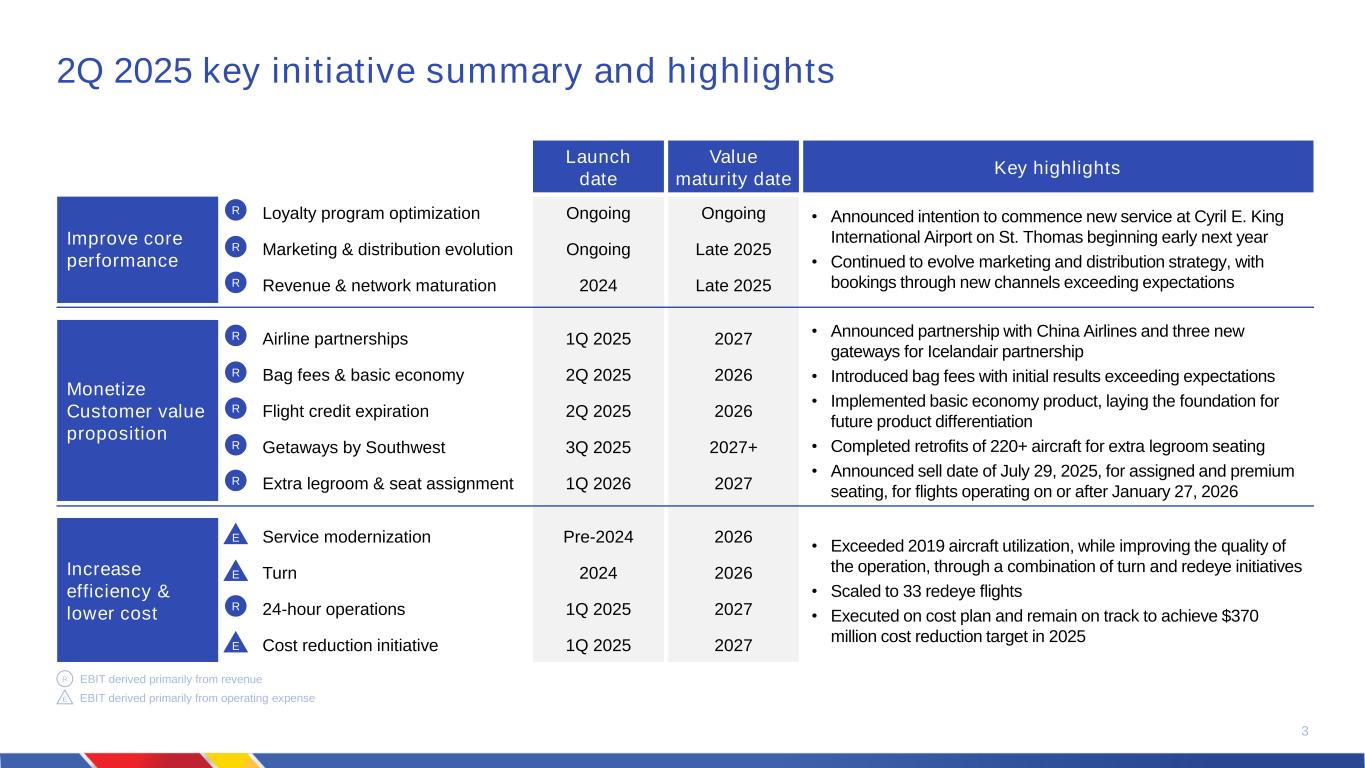

2Q 2025 key initiative summary and highlights 3 EBIT derived primarily from revenue EBIT derived primarily from operating expenseE R Launch date Value maturity date Key highlights Improve core performance Loyalty program optimization Ongoing Ongoing • Announced intention to commence new service at Cyril E. King International Airport on St. Thomas beginning early next year • Continued to evolve marketing and distribution strategy, with bookings through new channels exceeding expectations Marketing & distribution evolution Ongoing Late 2025 Revenue & network maturation 2024 Late 2025 Monetize Customer value proposition Airline partnerships 1Q 2025 2027 • Announced partnership with China Airlines and three new gateways for Icelandair partnership • Introduced bag fees with initial results exceeding expectations • Implemented basic economy product, laying the foundation for future product differentiation • Completed retrofits of 220+ aircraft for extra legroom seating • Announced sell date of July 29, 2025, for assigned and premium seating, for flights operating on or after January 27, 2026 Bag fees & basic economy 2Q 2025 2026 Flight credit expiration 2Q 2025 2026 Getaways by Southwest 3Q 2025 2027+ Extra legroom & seat assignment 1Q 2026 2027 Increase efficiency & lower cost Service modernization Pre-2024 2026 • Exceeded 2019 aircraft utilization, while improving the quality of the operation, through a combination of turn and redeye initiatives • Scaled to 33 redeye flights • Executed on cost plan and remain on track to achieve $370 million cost reduction target in 2025 Turn 2024 2026 24-hour operations 1Q 2025 2027 Cost reduction initiative 1Q 2025 2027 E E R E R R R R R R R R

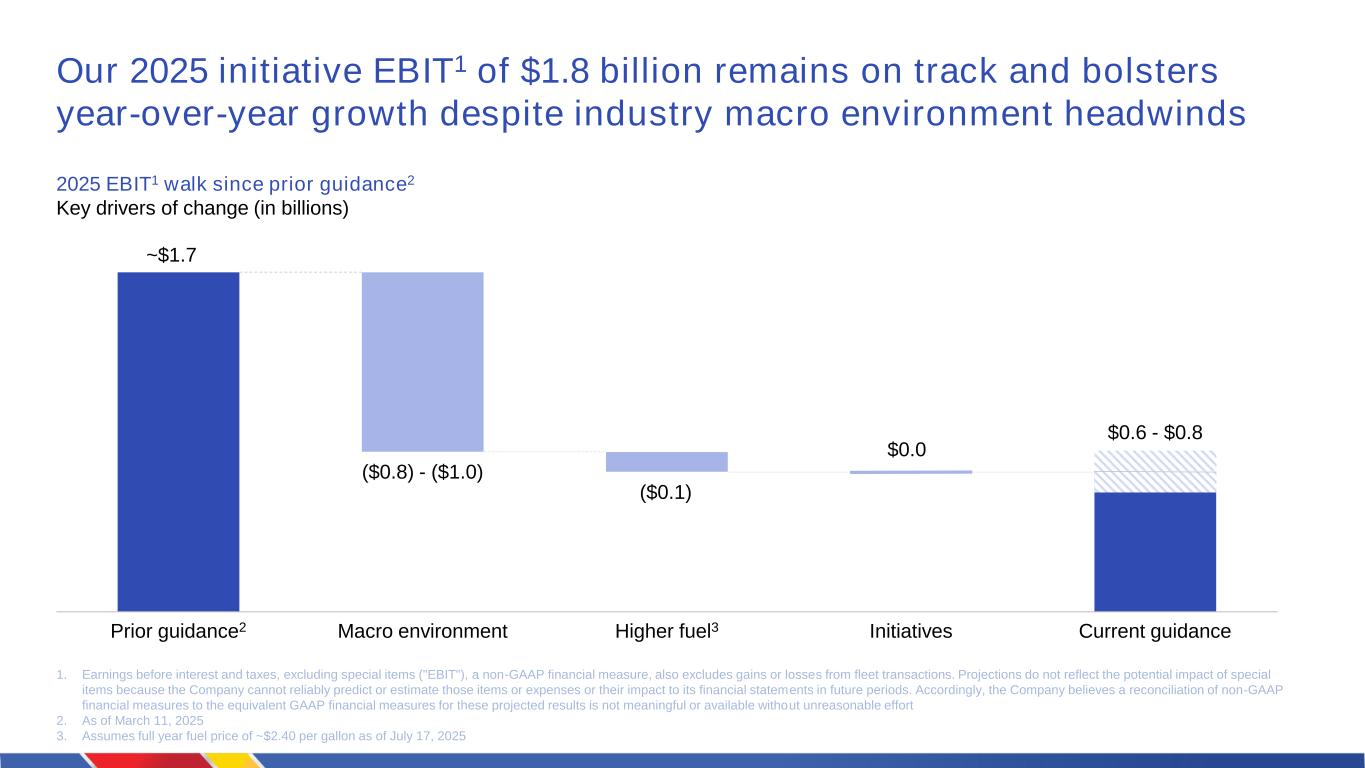

Our 2025 initiative EBIT1 of $1.8 billion remains on track and bolsters year-over-year growth despite industry macro environment headwinds 1. Earnings before interest and taxes, excluding special items ("EBIT"), a non-GAAP financial measure, also excludes gains or losses from fleet transactions. Projections do not reflect the potential impact of special items because the Company cannot reliably predict or estimate those items or expenses or their impact to its financial statements in future periods. Accordingly, the Company believes a reconciliation of non-GAAP financial measures to the equivalent GAAP financial measures for these projected results is not meaningful or available without unreasonable effort 2. As of March 11, 2025 3. Assumes full year fuel price of ~$2.40 per gallon as of July 17, 2025 Prior guidance2 Macro environment Higher fuel3 Initiatives Current guidance ~$1.7 ($0.8) - ($1.0) ($0.1) $0.6 - $0.8 2025 EBIT1 walk since prior guidance2 Key drivers of change (in billions) $0.0