EX-99.2 REGISTRANT'S SUPPLEMENTAL FINANCIAL INFORMATION

Published on October 24, 2024

3Q 2024 Earnings October 24, 2024

Summary of contents Additional detail on EBIT contributions Illustrative scorecard for planned quarterly updates Critical path milestone reporting for assigned and premium seating ROIC and margin targets for 2025 through 2027 'Southwest. Even Better.' 2027 financial targets Page 2

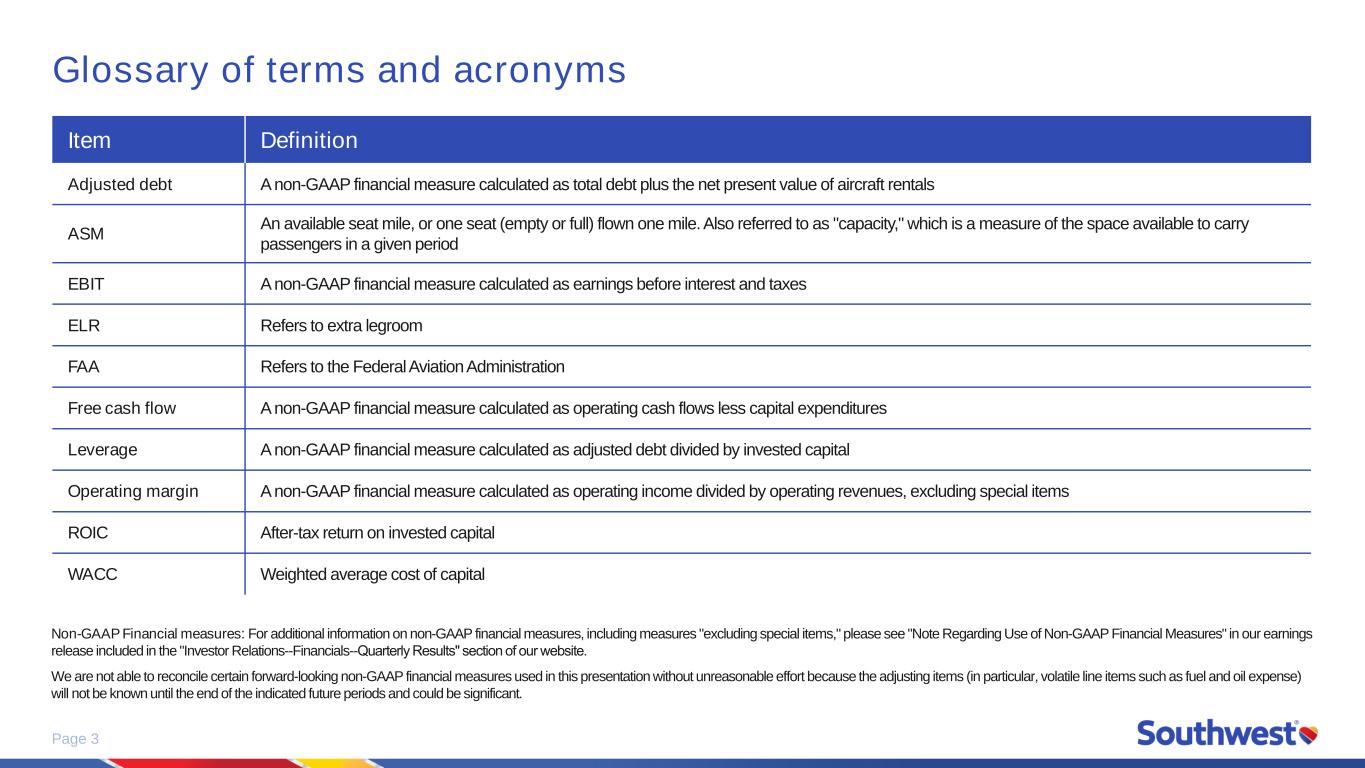

Page 3 Glossary of terms and acronyms Item Definition Adjusted debt A non-GAAP financial measure calculated as total debt plus the net present value of aircraft rentals ASM An available seat mile, or one seat (empty or full) flown one mile. Also referred to as "capacity," which is a measure of the space available to carry passengers in a given period EBIT A non-GAAP financial measure calculated as earnings before interest and taxes ELR Refers to extra legroom FAA Refers to the Federal Aviation Administration Free cash flow A non-GAAP financial measure calculated as operating cash flows less capital expenditures Leverage A non-GAAP financial measure calculated as adjusted debt divided by invested capital Operating margin A non-GAAP financial measure calculated as operating income divided by operating revenues, excluding special items ROIC After-tax return on invested capital WACC Weighted average cost of capital Non-GAAP Financial measures: For additional information on non-GAAP financial measures, including measures "excluding special items," please see "Note Regarding Use of Non-GAAP Financial Measures" in our earnings release included in the "Investor Relations--Financials--Quarterly Results" section of our website. We are not able to reconcile certain forward-looking non-GAAP financial measures used in this presentation without unreasonable effort because the adjusting items (in particular, volatile line items such as fuel and oil expense) will not be known until the end of the indicated future periods and could be significant.

Page 4 Cautionary statement regarding forward-looking statements This Investor Update contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are based on, and include statements about, the Company’s current estimates, intentions, beliefs, expectations, goals, strategies, and projections for the future and are not guarantees of future performance. Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, statements related to (i) the Company's financial and operational outlook, expectations, goals, plans, strategies, and projected results of operations, including with respect to its initiatives, and including factors and assumptions underlying the Company's expectations and projections; (ii) the Company’s initiatives, strategic priorities and focus areas, plans, goals, expectations, and opportunities, including with respect to (a) network optimization and maturation, (b) marketing and distribution evolution, (c) improving revenue performance and revenue management, (d) assigned and premium seating, (e) airline partnerships and enhanced vacation products, including Getaways by Southwest, (f) aircraft turn-time, (g) redeye flying and 24-hour operation capabilities, (h) innovation, Customer Service modernization, and Customer Experience enhancements, (i) managing and mitigating cost pressures and removing costs, (j) enhancing efficiency, growth initiatives and efficient use of capital, and capital allocation, (k) fleet strategy and extracting value from the fleet and the fleet order book, (l) creating value for Shareholders and Shareholder returns; and (m) maintaining investment grade credit rating; (iii) the Company’s fleet plans and expectations, including with respect to fleet utilization, fleet modernization, fleet management, flexibility, expected fleet deliveries and retirements, refreshed cabin design, in-seat power, larger overhead bins, increased WiFi, and new RECARO seats, and including factors and assumptions underlying the Company's plans and expectations; (iv) the Company’s plans and expectations with respect to its network, its capacity, its network optimization efforts, its network plan, network restructurings, market maturation, refining connection opportunities, and capacity and network adjustments, including its plans and expectations with respect to; and including factors and assumptions underlying the Company's expectations and projections; (v) the Company's plans, estimates, and assumptions related to repayment of debt obligations, leverage, credit ratings, interest expense, capital spending, including factors and assumptions underlying the Company's expectations and projections. Forward-looking statements involve risks, uncertainties, assumptions, and other factors that are difficult to predict and that could cause actual results to vary from those expressed in or indicated by them. Factors include, among others, (i) the impact of fears or actual outbreaks of diseases, extreme or severe weather and natural disasters, actions of competitors (including, without limitation, pricing, scheduling, capacity, and network decisions, and consolidation and alliance activities), consumer perception, economic conditions, banking conditions, fears or actual acts of terrorism or war, sociodemographic trends, and other factors beyond the Company's control, on consumer behavior and the Company's results of operations and business decisions, plans, strategies, and results; (ii) the Company's ability to timely and effectively implement, transition, operate, and maintain the necessary information technology systems and infrastructure to support its operations and initiatives, including with respect to revenue management and assigned and premium seating; (iii) the cost and effects of the actions of activist shareholders; (iv) the Company’s ability to obtain and maintain adequate infrastructure and equipment to support its operations and initiatives; (v) the impact of fuel price changes, fuel price volatility, volatility of commodities used by the Company for hedging jet fuel, and any changes to the Company's fuel hedging strategies and positions, on the Company's business plans and results of operations; (vi) the Company's dependence on The Boeing Company (“Boeing”) and Boeing suppliers with respect to the Company's aircraft deliveries, Boeing MAX 7 aircraft certifications, fleet and capacity plans, operations, maintenance, strategies, and goals; (vii) the Company's dependence on the Federal Aviation Administration with respect to safety approvals for the new cabin layout and the certification of the Boeing MAX 7 aircraft; (viii) the Company's dependence on other third parties, in particular with respect to its technology plans, its plans and expectations related to revenue management, operational reliability, fuel supply, maintenance, Global Distribution Systems, environmental sustainability, and the impact on the Company's operations and results of operations of any third party delays or nonperformance; (ix) the Company’s ability to timely and effectively prioritize its initiatives and focus areas and related expenditures; (x) the impact of labor matters on the Company's business decisions, plans, strategies, and results; (xi) the impact of governmental regulations and other governmental actions on the Company's business plans, results, and operations; (xii) the Company's dependence on its workforce, including its ability to employ and retain sufficient numbers of qualified Employees with appropriate skills and expertise to effectively and efficiently maintain its operations and execute the Company’s plans, strategies, and initiatives; (xiii) the emergence of additional costs or effects associated with the cancelled flights in December 2022, including litigation, government investigation and actions, and internal actions; and (xiv) other factors, as described in the Company's filings with the Securities and Exchange Commission, including the detailed factors discussed under the heading "Risk Factors" in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and in the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2024.

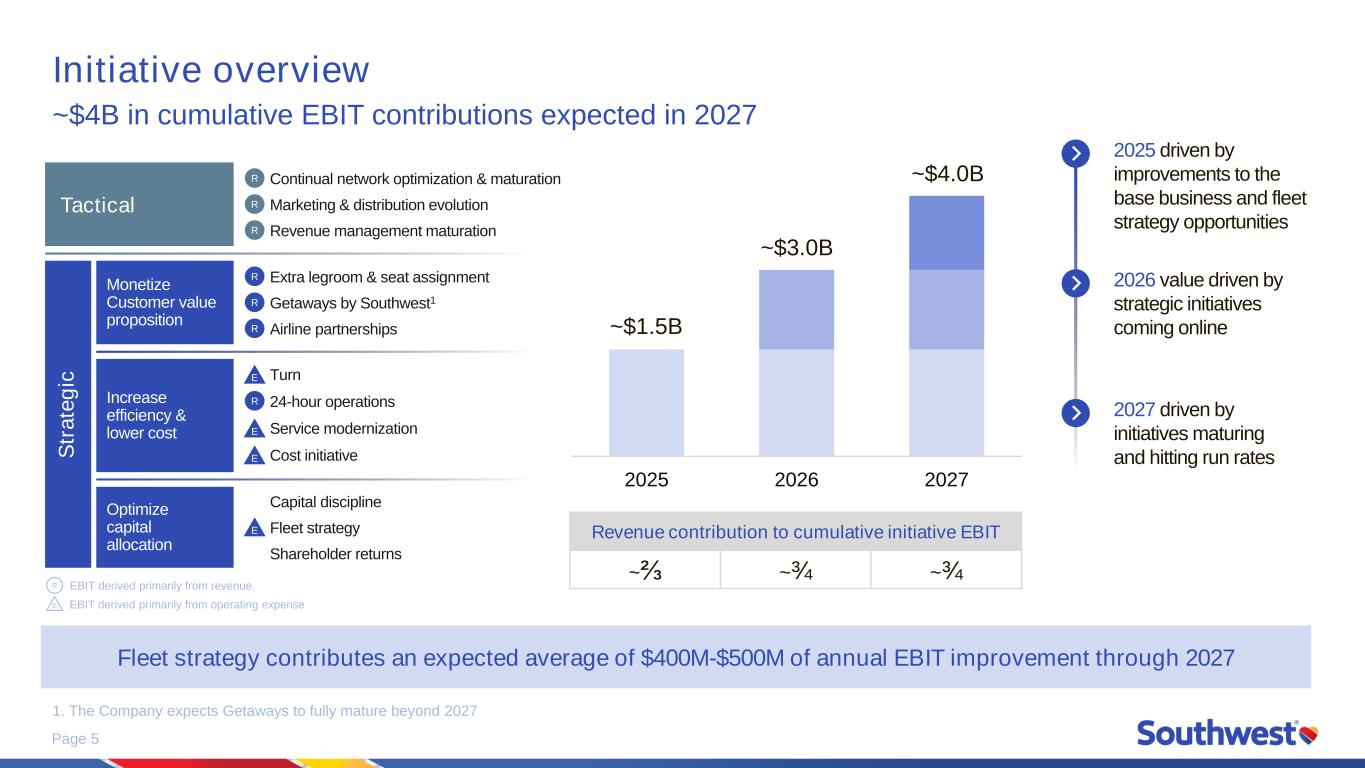

Page 5 Initiative overview ~$4B in cumulative EBIT contributions expected in 2027 1. The Company expects Getaways to fully mature beyond 2027 Monetize Customer value proposition Optimize capital allocation Increase efficiency & lower cost Tactical S tr a te g ic Continual network optimization & maturationR Marketing & distribution evolutionR Revenue management maturationR Extra legroom & seat assignmentR Getaways by Southwest1R Airline partnershipsR Capital discipline Fleet strategy Shareholder returns E Turn 24-hour operationsR Fleet strategy contributes an expected average of $400M-$500M of annual EBIT improvement through 2027 2025 2026 2027 Revenue contribution to cumulative initiative EBIT ~⅔ ~¾ ~¾ ~$1.5B ~$3.0B ~$4.0B 2025 driven by improvements to the base business and fleet strategy opportunities 2026 value driven by strategic initiatives coming online 2027 driven by initiatives maturing and hitting run rates E Service modernization E Cost initiative E EBIT derived primarily from revenue EBIT derived primarily from operating expenseE R

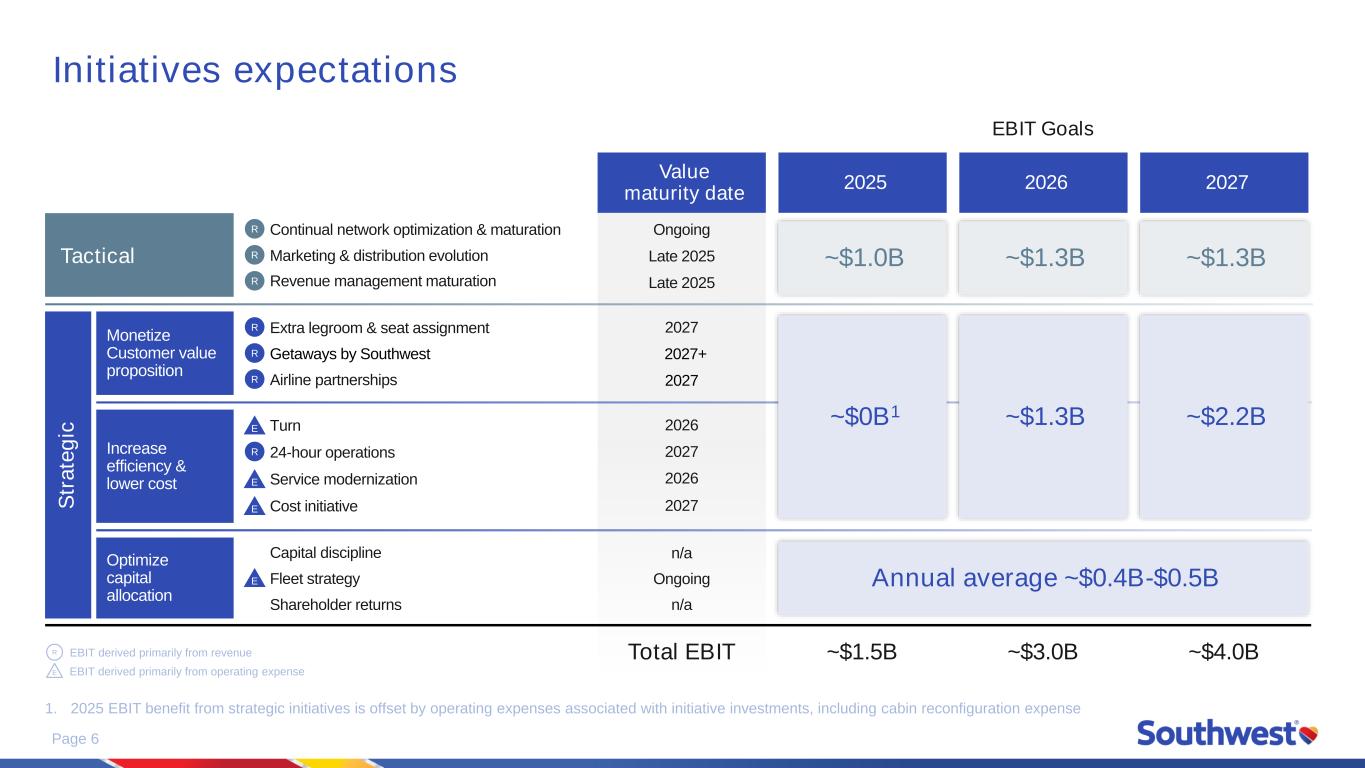

Page 6 Initiatives expectations 1. 2025 EBIT benefit from strategic initiatives is offset by operating expenses associated with initiative investments, including cabin reconfiguration expense Value maturity date Ongoing Late 2025 Late 2025 2027 2027+ 2027 2026 2027 2026 2027 n/a Ongoing n/a Total EBIT 2025 ~$1.5B 2026 ~$3.0B 2027 ~$4.0B Monetize Customer value proposition Optimize capital allocation Increase efficiency & lower cost Tactical S tr a te g ic Continual network optimization & maturationR Marketing & distribution evolutionR Revenue management maturationR Extra legroom & seat assignmentR Getaways by SouthwestR Airline partnershipsR Capital discipline Fleet strategy Shareholder returns E Turn 24-hour operationsR E Service modernization E Cost initiative E EBIT derived primarily from revenue EBIT derived primarily from operating expenseE R ~$1.0B ~$0B1 ~$1.3B ~$1.3B ~$1.3B ~$2.2B Annual average ~$0.4B-$0.5B EBIT Goals

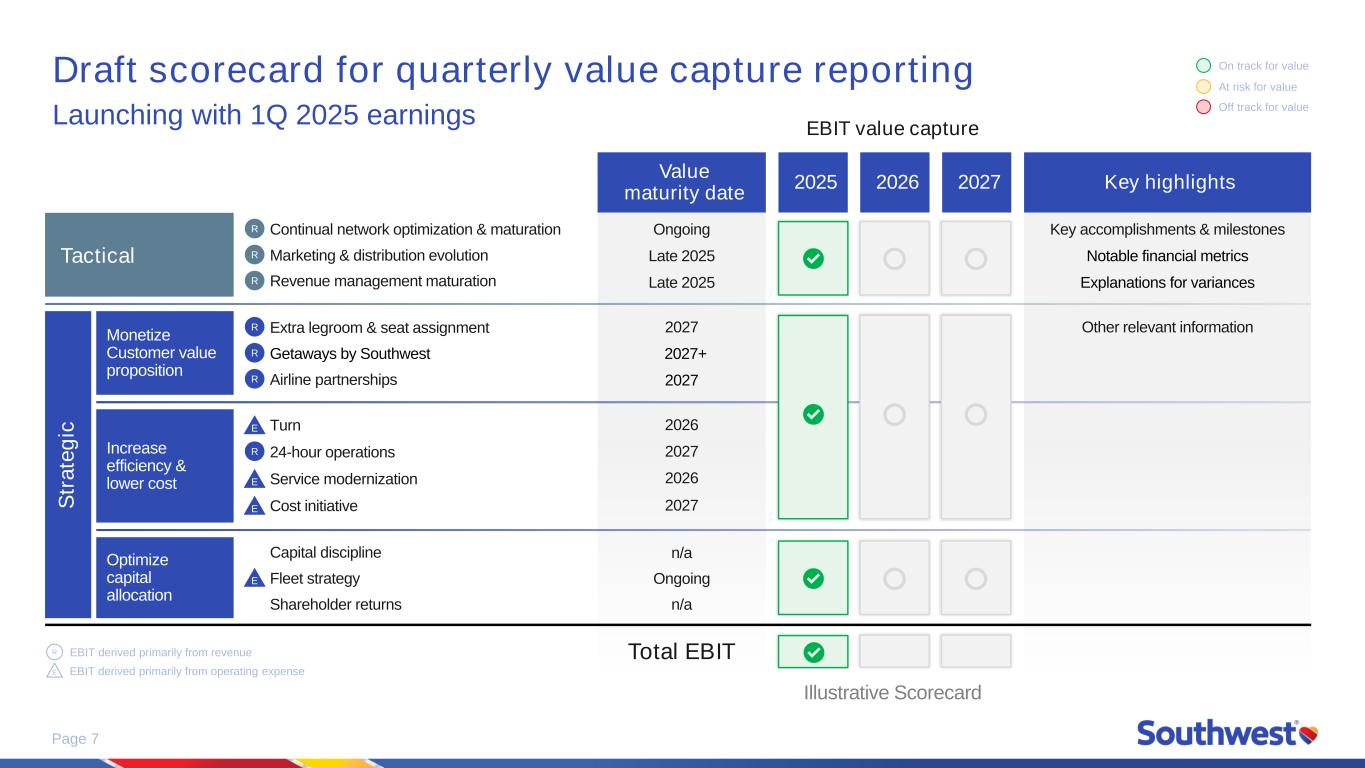

Page 7 Draft scorecard for quarterly value capture reporting Launching with 1Q 2025 earnings Key highlights Key accomplishments & milestones Notable financial metrics Explanations for variances Other relevant information Value maturity date Ongoing Late 2025 Late 2025 2027 2027+ 2027 2026 2027 2026 2027 n/a Ongoing n/a Total EBIT 2025 2026 2027 Monetize Customer value proposition Optimize capital allocation Increase efficiency & lower cost Tactical S tr a te g ic Continual network optimization & maturationR Marketing & distribution evolutionR Revenue management maturationR Extra legroom & seat assignmentR Getaways by SouthwestR Airline partnershipsR Capital discipline Fleet strategy Shareholder returns E Turn 24-hour operationsR E Service modernization E Cost initiative E EBIT derived primarily from revenue EBIT derived primarily from operating expenseE R EBIT value capture On track for value At risk for value Off track for value Illustrative Scorecard

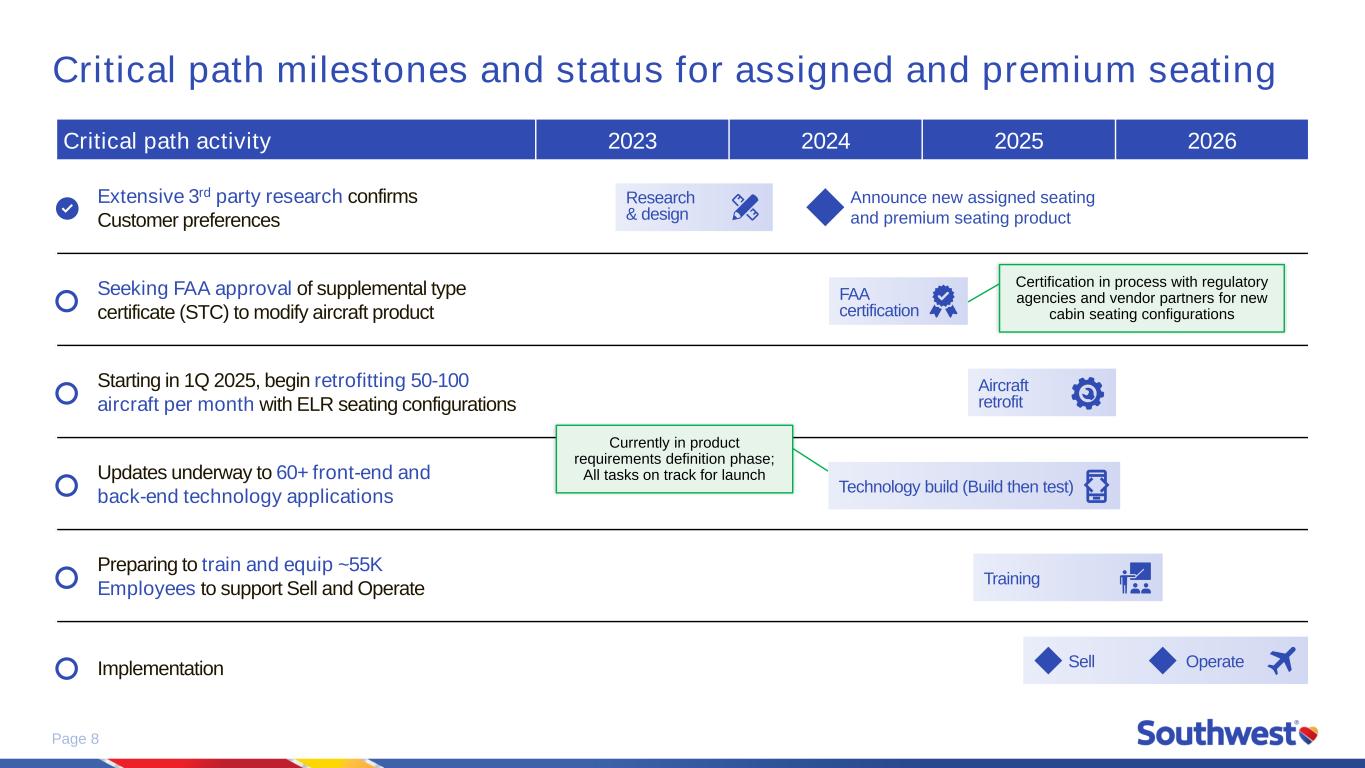

Page 8 Critical path milestones and status for assigned and premium seating Critical path activity 2023 2024 2025 2026 Extensive 3rd party research confirms Customer preferences Seeking FAA approval of supplemental type certificate (STC) to modify aircraft product Starting in 1Q 2025, begin retrofitting 50-100 aircraft per month with ELR seating configurations Updates underway to 60+ front-end and back-end technology applications Preparing to train and equip ~55K Employees to support Sell and Operate Implementation Research & design FAA certification Announce new assigned seating and premium seating product Aircraft retrofit Technology build (Build then test) Training Sell Operate Certification in process with regulatory agencies and vendor partners for new cabin seating configurations Currently in product requirements definition phase; All tasks on track for launch

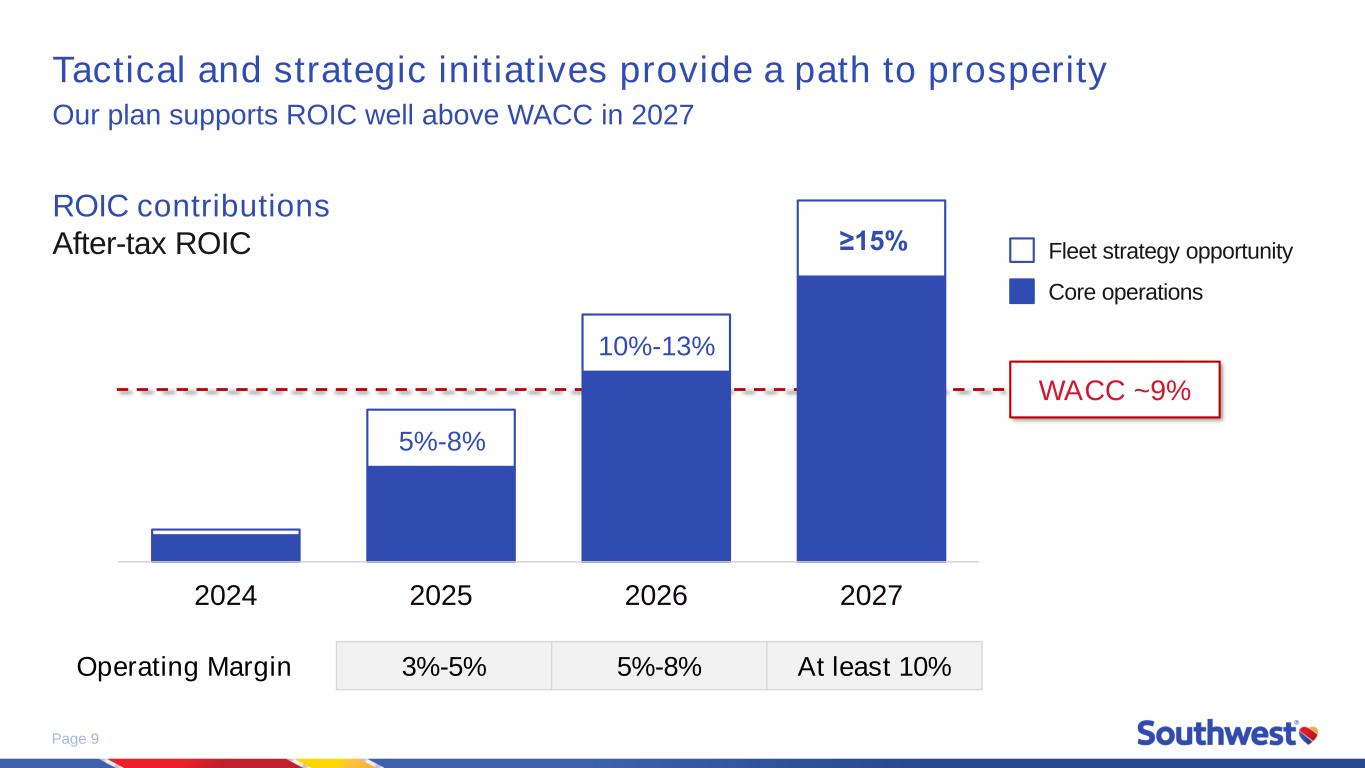

Page 9 Tactical and strategic initiatives provide a path to prosperity Our plan supports ROIC well above WACC in 2027 ROIC contributions After-tax ROIC 2024 2025 2026 2027 Operating Margin 3%-5% 5%-8% At least 10% 5%-8% 10%-13% ≥15% Fleet strategy opportunity Core operations WACC ~9%

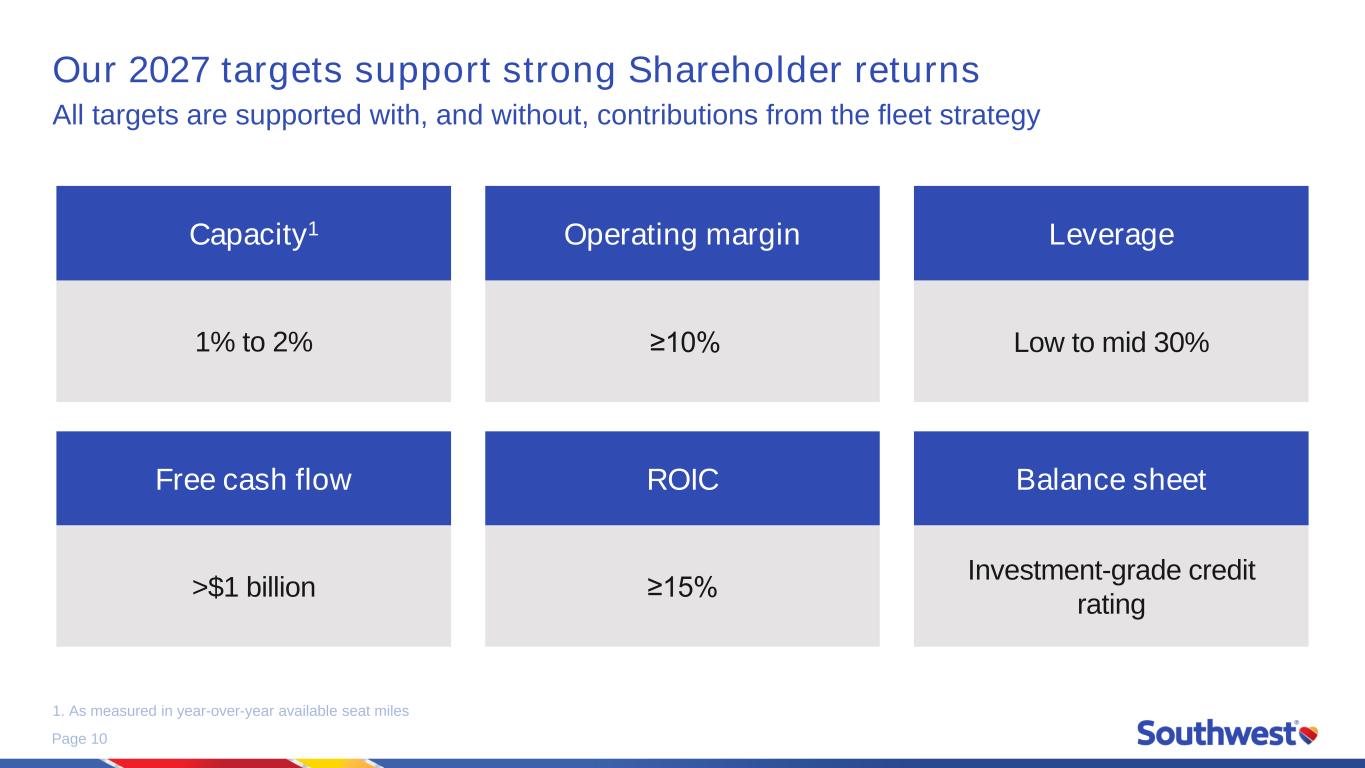

Page 10 Our 2027 targets support strong Shareholder returns All targets are supported with, and without, contributions from the fleet strategy 1. As measured in year-over-year available seat miles 1% to 2% Capacity1 >$1 billion Free cash flow Low to mid 30% Leverage Investment-grade credit rating Balance sheet ~10% Operating margin ≥15% ROIC ≥